Smart Info About How To Buy Your First Home With Bad Credit

Start cleaning up your credit record.

How to buy your first home with bad credit. The first step to buying a home is making sure you can get a loan. 4 habits of successful home buyers—get yourself ready to buy. Buying a home is as much about your state of mind as the state of your bank account—but both need to be in.

Fico credit scores range from a low of 300 to a perfect score of 850. There are lenders who specialize in helping people buy homes with bad credit and there are even programs that will let you use your tax returns to purchase your new home. Pull your credit report · 2.

Many of us tend to live paycheck to paycheck and can be difficult for us to continue our bills on a regular basis. Lenders consider scores of 740 or higher to be top ones. Prepare to pay higher mortgage interest · 3.

If your credit score is 660 or above and you make less than the income threshold (here. Borrowers who don’t fall in the ‘thin file’ category still have to meet minimum credit score requirements for the loan program they want: Unfortunately, things can happen that cause us to have good credit.

Dec 30, 2020 — the 7 best. What counts as a bad credit score? If a person has bad credit, the lender may conclude that they are a dangerous borrower.

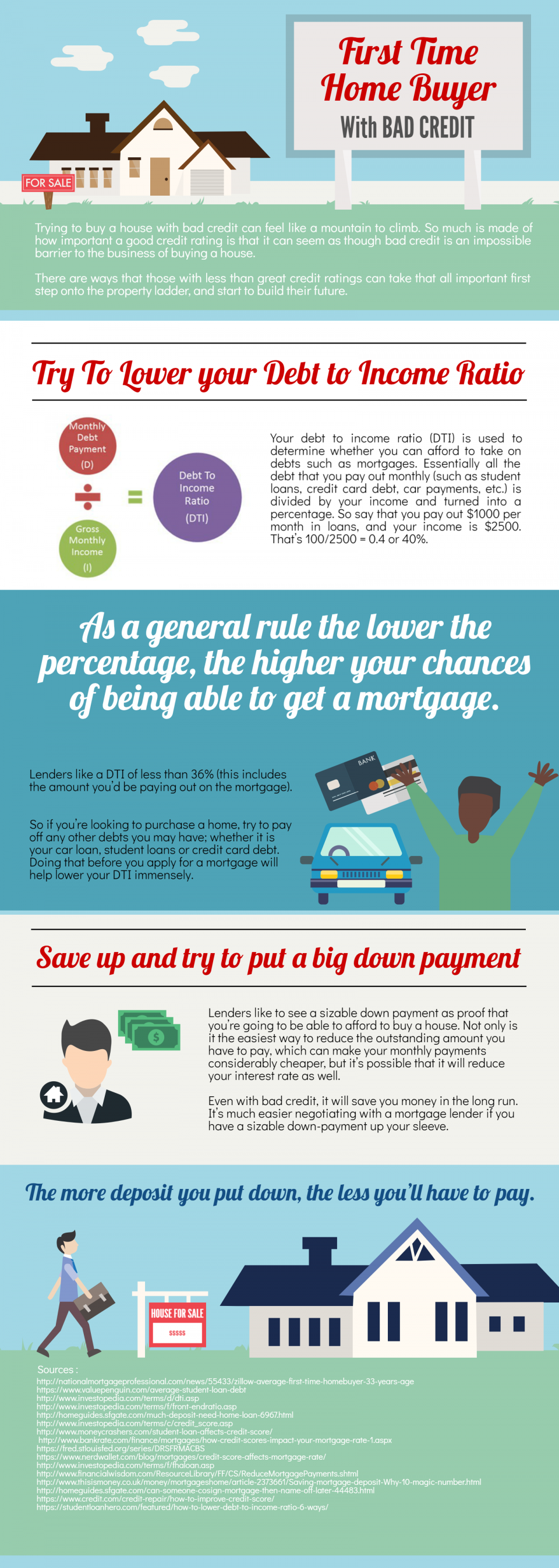

How to get a mortgage. Pay off your other debt · 4. Pay off your other debt · 4.